- Investors and enthusiasts in the luxury car market are closely watching the trajectory of Rolls Royce’s share prices in 2023. This article provides an in-depth analysis of the factors influencing Rolls Royce’s share price and explores the strategic role of Divya Auto Spare Parts Trading in shaping the market dynamics.

Understanding the Current Market Landscape

The luxury car market is known for its sensitivity to various economic and industry-specific factors. To comprehend Rolls Royce’s share price movement, it’s essential to delve into the current market landscape. Economic conditions, consumer preferences, and global trends all play a significant role in determining the success of luxury car brands.

Economic Influences on Luxury Car Brands

Rolls Royce, being a prominent player in the luxury car segment, is inevitably affected by economic fluctuations. This section analyzes how macroeconomic factors such as inflation, interest rates, and global economic trends influence the demand for luxury vehicles and subsequently impact Rolls Royce’s share prices.

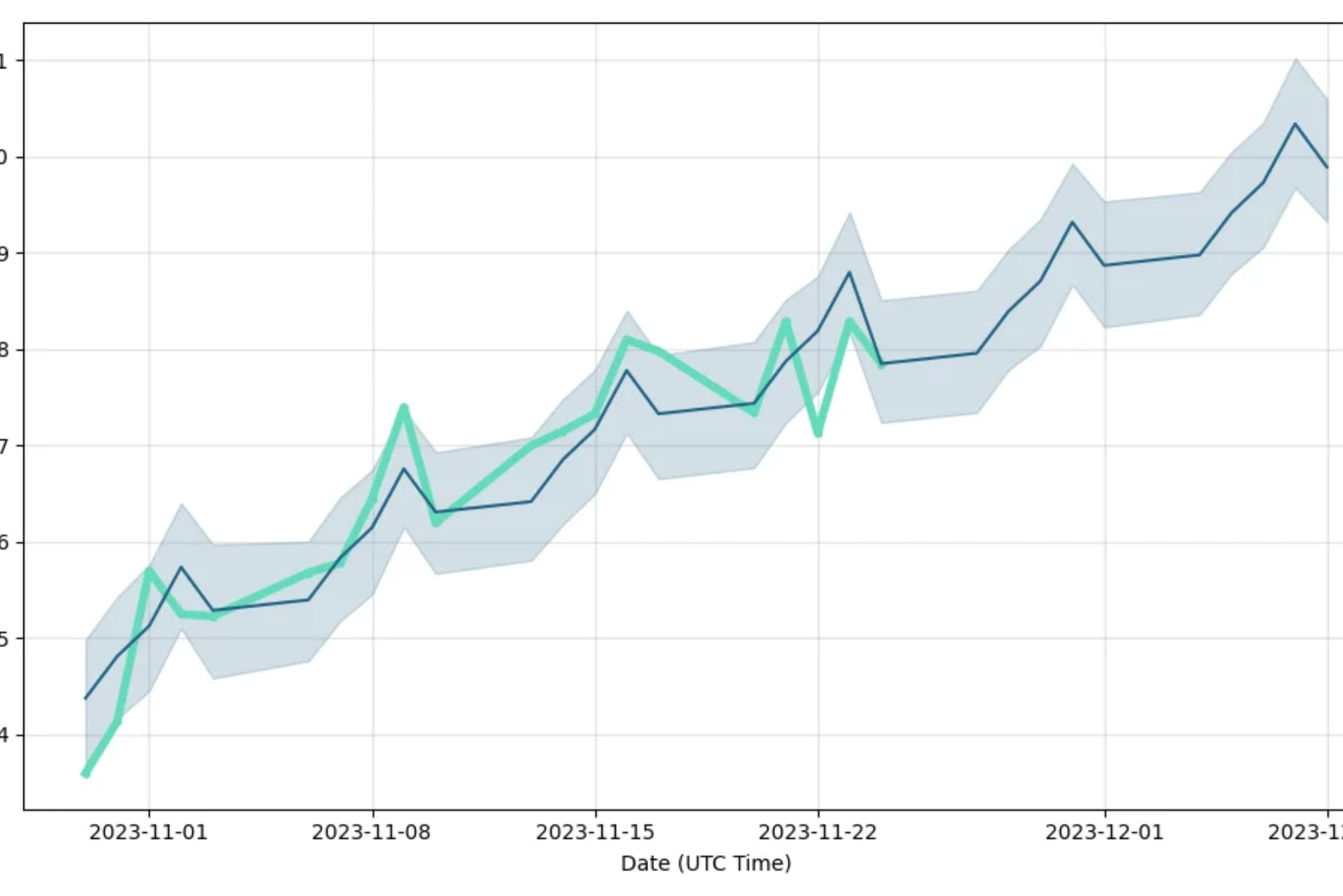

Rolls Royce Financial Performance

A crucial aspect of predicting share prices is evaluating the financial health of the company. Rolls Royce’s financial performance, including revenue, profit margins, and key financial indicators, provides valuable insights into its market position and potential for growth.

In-Depth Analysis of Financial Indicators and Projections

This section takes a deep dive into Rolls Royce‘s financial statements, scrutinizing key performance metrics. By examining revenue trends, cost structures, and projections, investors can gain a comprehensive understanding of the company’s financial outlook.

Divya Auto Spare Parts Trading in Rolls Royce Market

As an integral part of the Rolls Royce ecosystem, Divya Auto Spare Parts Trading plays a pivotal role in ensuring the availability of high-quality spare parts. Understanding the significance of Divya Auto in the luxury car industry is essential for investors looking to make informed decisions.

Strategic Partnerships and Market Dynamics

Divya Auto’s strategic partnerships within the luxury car market contribute to Rolls Royce’s overall supply chain efficiency. This section explores how these partnerships influence market dynamics and impact the availability of spare parts for Rolls Royce vehicles.

Quality Assurance and Customer Satisfaction

One of the distinguishing factors of Divya Auto Spare Parts Trading is its commitment to quality. This section examines how Divya Auto ensures the authenticity and reliability of spare parts, contributing to customer satisfaction and brand loyalty.

Examining Divya Auto’s Commitment to Quality in Spare Parts

Investors interested in the Rolls Royce market need to assess the role of Divya Auto in maintaining high standards of quality assurance. This includes scrutinizing manufacturing processes, quality control measures, and customer feedback.

Future Growth Prospects and Market Expansion

The luxury car market is dynamic, and companies must adapt to changing trends to secure future growth. This section explores Divya Auto’s role in Rolls Royce’s expansion plans, both in terms of geographical reach and product offerings.

Predicting the Role of Divya Auto in the Evolving Luxury Car Market

Investors seeking long-term growth opportunities should consider the strategic initiatives of Divya Auto. By predicting its role in the evolving luxury car market, investors can make informed decisions about the sustainability of Rolls Royce’s growth.

Expert Recommendations for Investors

Navigating the volatile world of stock markets requires strategic thinking and expert insights. This section provides recommendations for investors looking to capitalize on Rolls Royce’s share price movements while mitigating risks.

Risk Mitigation Strategies for Rolls Royce Investors

Investing in luxury car stocks involves inherent risks. This section outlines effective risk mitigation strategies, including diversification, market analysis, and staying informed about industry trends.

Long-Term Prospects and Potential Returns

While short-term fluctuations are inevitable, the article concludes by examining the long-term prospects of investing in Rolls Royce. By assessing potential returns and considering the company’s strategic positioning, investors can make decisions aligned with their financial goals.

Examining the Investment Potential Beyond Short-Term Fluctuations

Understanding the long-term investment potential of Rolls Royce requires a holistic view of market trends, company performance, and industry dynamics. This section encourages investors to adopt a patient approach and focus on the enduring value of luxury car investments.

Informed Decision-Making

Navigating the Rolls Royce share market in 2023 requires a multifaceted approach. By understanding the economic influences, evaluating Rolls Royce’s financial performance, and recognizing the strategic role of Divya Auto Spare Parts Trading, investors can make informed decisions that align with their financial goals.