The Eurozone, a monetary union comprising 19 of the 27 European Union (EU) member states, faced a severe economic challenge known as the Eurozone Debt Crisis. This comprehensive article aims to delve into the origins, impact, and future prospects of this crisis, shedding light on the complexities that have shaped the economic landscape of the Eurozone.

What Led to the Eurozone Debt Crisis?

Global Financial Crisis

The roots of the Eurozone debt crisis can be traced back to the global financial crisis of 2008. The collapse of major financial institutions and the subsequent economic downturn had a profound impact on the interconnected global markets. This crisis reverberated throughout the Eurozone, setting the stage for the challenges that would follow.

Sovereign Debt Issues

One of the primary contributors to the Eurozone debt crisis was the accumulation of sovereign debt by several Eurozone countries. Nations like Greece, Spain, and Italy faced mounting debt burdens, threatening the stability of the entire Eurozone. The fiscal policies adopted by these countries, coupled with the inability to manage their debt effectively, created a domino effect that shook the economic foundations of the region.

Greece: The Epicenter of the Crisis

Greece, in particular, became the epicenter of the crisis, revealing weaknesses in the Eurozone’s design. Examine how Greece’s excessive borrowing, coupled with widespread tax evasion and inefficient public administration, led to a debt spiral that sent shockwaves across the entire Eurozone.

Impact on Eurozone Countries

Economic Recession

The Eurozone debt crisis resulted in a severe economic downturn, pushing several countries into recession. Explore the specific impacts on GDP growth, unemployment rates, and overall economic well-being. Understand how the recessionary pressures varied across different nations, highlighting the interconnected yet diverse nature of the Eurozone economy.

Unemployment Challenges

Unemployment rates skyrocketed in many Eurozone countries, with the youth being disproportionately affected. Delve into the social and economic implications of soaring unemployment, and how it strained the social fabric of affected nations.

Austerity Measures

To address the crisis, many Eurozone countries implemented austerity measures. These measures aimed to reduce budget deficits by cutting public spending and increasing taxes. Investigate the impact of austerity on public services, social welfare, and the overall well-being of citizens. Analyze the social unrest and political ramifications triggered by these measures.

Social Consequences of Austerity

Examine the human toll of austerity, including protests, strikes, and political upheavals. Understand how citizens, frustrated by economic hardships, voiced their concerns against the implemented austerity measures.

Responses and Solutions

European Central Bank Intervention

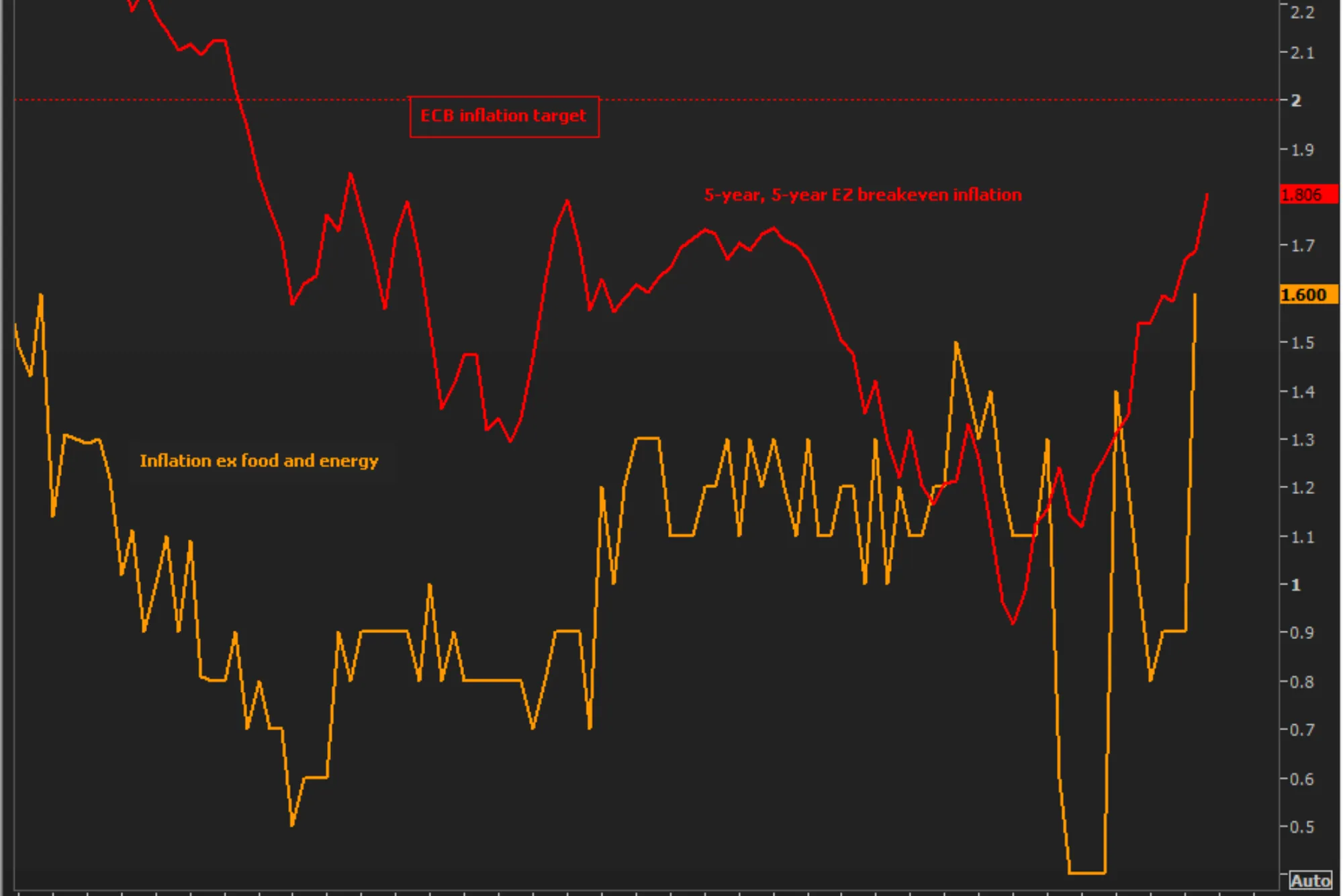

The European Central Bank (ECB) played a crucial role in stabilizing the Eurozone during the crisis. Explore the interventions and policies implemented by the ECB to mitigate the eurozone dubai effects and restore confidence in financial markets.

Monetary Policy Measures

Dive deep into the specific monetary policy measures adopted by the ECB, including interest rate adjustments, quantitative easing, and unconventional policies. Assess the effectiveness of these measures in addressing the multifaceted challenges posed by the Eurozone debt crisis.

Structural Reforms

Several Eurozone countries undertook structural reforms to address underlying economic issues. Explore how these reforms aimed to enhance competitiveness, fiscal responsibility, and overall economic resilience. Assess the long-term impact of structural reforms on the economic landscape of the Eurozone.

Case Studies: Reforms in Spain and Portugal

Analyze case studies of Spain and Portugal, two countries that implemented significant structural reforms. Understand the specific reforms undertaken, the challenges faced, and the outcomes achieved, providing insights into the complexities of reforming diverse economies within the Eurozone.

Future Prospects and Challenges

Ongoing Challenges

Despite interventions and reforms, the Eurozone faces ongoing challenges. Analyze the persistent issues such as economic disparities, political tensions, and external threats that could impact the region’s economic stability in the coming years.

Brexit and Its Implications

Explore the impact of Brexit on the Eurozone, considering the economic and political ramifications. Understand how the departure of the United Kingdom has altered the dynamics within the Eurozone and posed additional challenges for the remaining member states.

Potential Solutions

Consider potential solutions and strategies to strengthen the Eurozone’s resilience against future economic crises. Assess the role of cooperation, policy adjustments, and global economic factors in shaping the region’s future. Explore innovative approaches to address the structural issues within the Eurozone and promote sustainable economic growth.

The Role of Digital Innovation

Investigate how digital innovation and technological advancements can play a pivotal role in transforming the economic landscape of the Eurozone. Explore the potential benefits of embracing digitalization to enhance productivity, efficiency, and competitiveness.

the Eurozone debt crisis serves as a critical juncture in the economic history of Europe. By understanding its origins, impact, and future prospects, we gain valuable insights into the complex dynamics that shape the Eurozone’s economic landscape. As nations continue to navigate challenges, strategic reforms, and collaborative efforts remain key to ensuring stability and prosperity in the ever-evolving economic environment.